Appearance

CP Overview

On the CP page you can modify a couple of things.

Settings

Tax calculation

Determine how you entered the product prices. e.g. if you entered them without tax, select "exclusive". This way we can ensure we calculate the correct price for your tax.

Tax default rate

Set the correct default tax rate that we should use when the user did not set a tax rate via the tax_rate="" param

Validate tax number

Validate the tax number of the customer, both ins syntax as with the VIES service

Allow empty TAX number

By default we allow empty tax numbers. If you want to force the user to fill in a tax number, disable this option

Reverse charge TAX for EU store owners

This invoice uses the reverse charge mechanism under Article 17 of the VAT Act. No VAT is charged by the supplier. Instead, as the buyer, you are required to calculate, report, and pay the applicable VAT in your own country via your VAT return. This rule is commonly used for cross-border business transactions within the EU and shifts the VAT responsibility from the seller to the buyer.

In addtion to the Validate TAX Number setting, we are force TAX NO validtion for all EU countries when this setting has been anabled.

Default member field country

Get the country from the member field. If the member field is empty, the default country will be used. You should save the country code in this field. You can do this by using {exp:reinos_store:country_list field_name="m_field_id_....." value="{member_field_for_country}"} in your registration/edit form.

Default country

Use this country as default to calculate the TAX

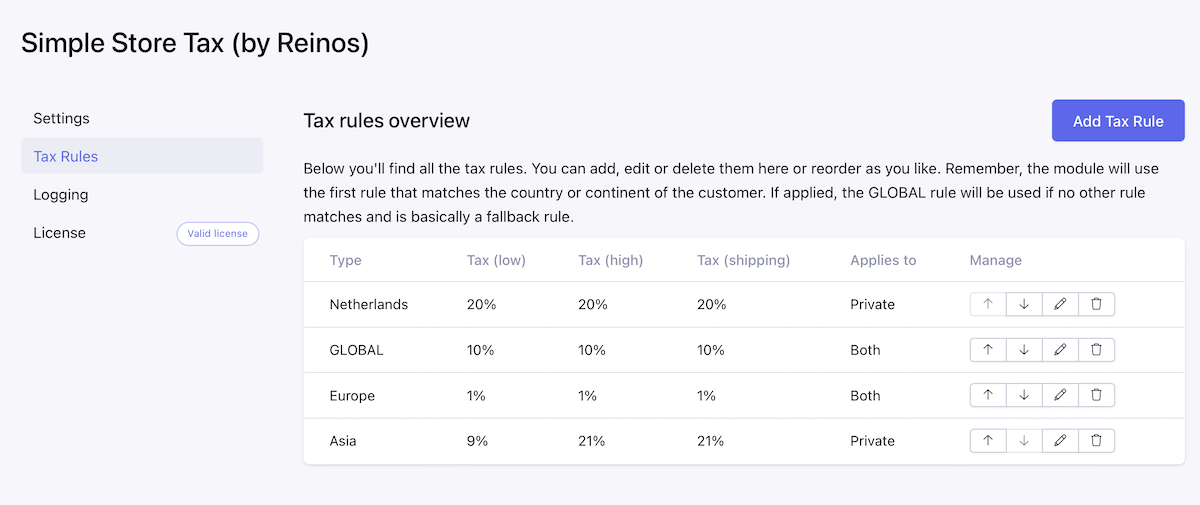

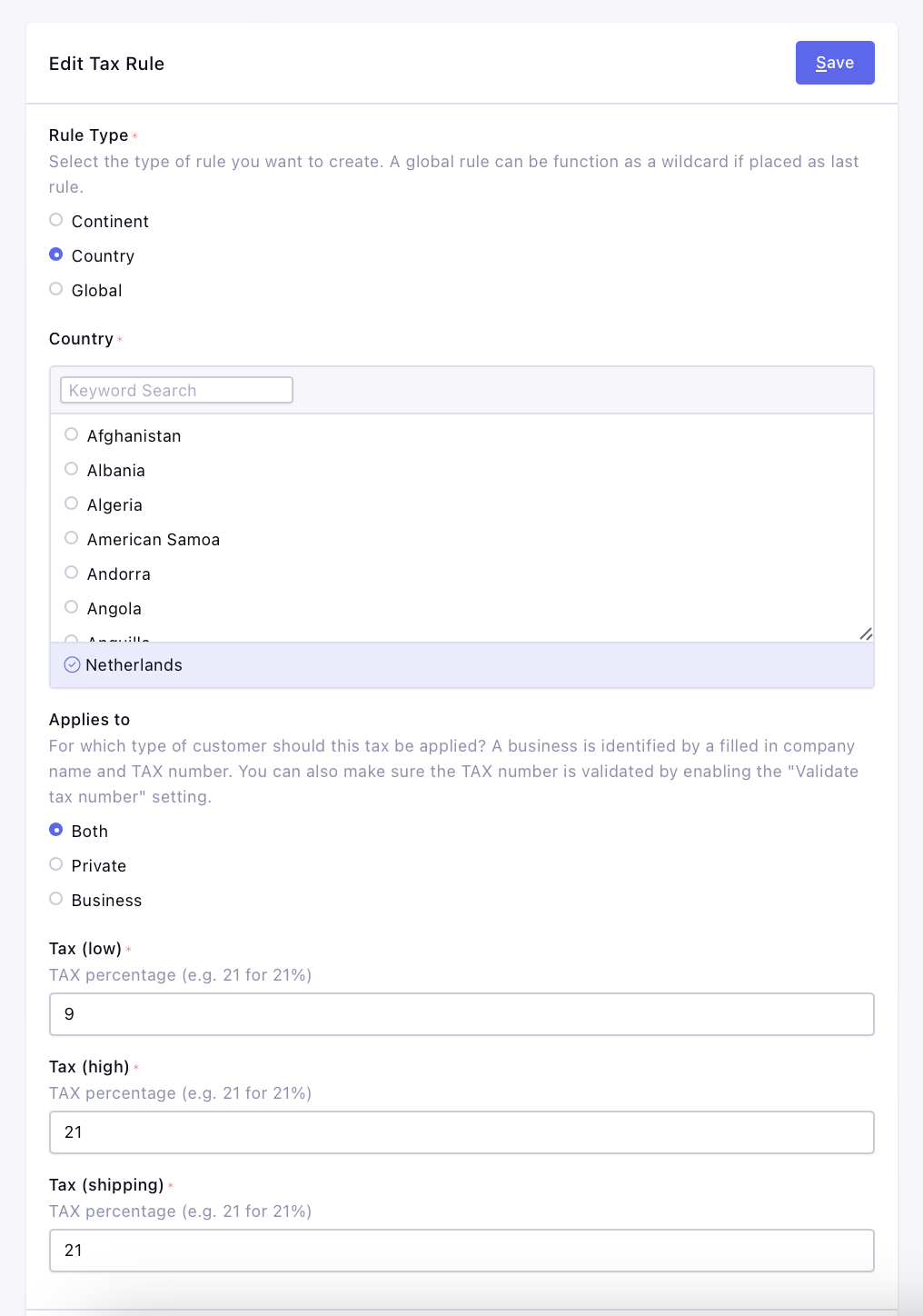

TAX rules

Here you can set your TAX rules. You can define them by Country or Continent or you can set a GLOBAL TAX rule. Remember, order matters. So the first rule will apply if multiple are found.

Logging

This is where you can track all error logs

License

Enter your license key to activate your module